Tired of juggling multiple cards for your online transactions?

Well, I've got great news for you. I've put together the ultimate guide to the best virtual card services out there, perfect for all your online transactions and media buying needs across platforms like Google Ads, Facebook Ads, TikTok Ads, and more.

And get this – many of these virtual cards even let you spend your crypto at regular stores!

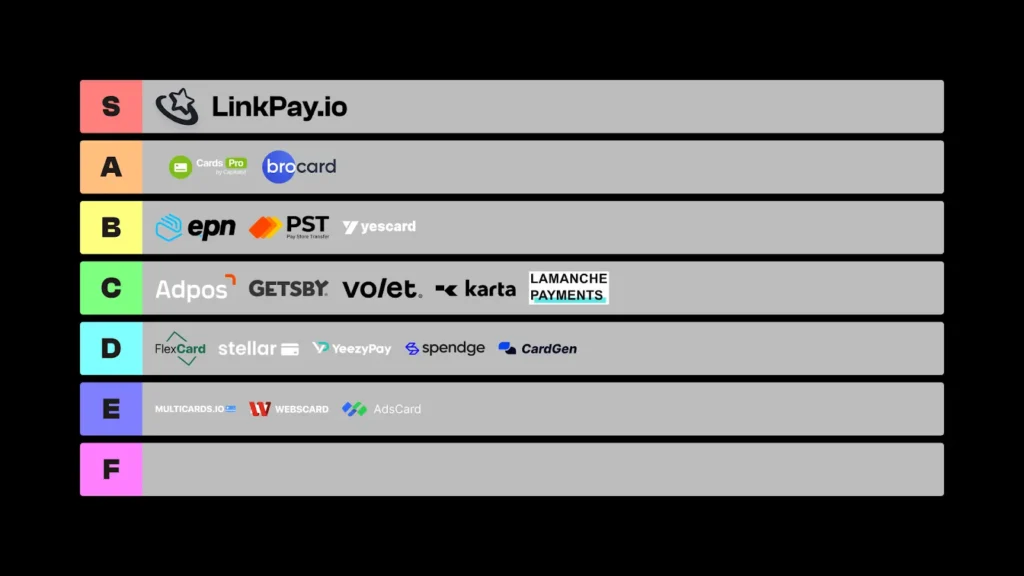

To make it easy for you to choose, I've ranked the top virtual cards from the cream of the crop (tier S) to the ones you might want to avoid (tier F). In the later sections, you’ll find a complete overview of these virtual cards, while covering detailed criteria for the evaluation.

Top Virtual Cards Of 2024 For Media Buying

| Card Name | Key Features | Supported Platforms | Pricing/Fees | Cashback |

|---|---|---|---|---|

| LinkPay | 3% cashback, 0% deposit/withdrawal fees, team management | Multiple ad platforms | Low key withdrawal threshold | Up to 3% |

| MyBroCard (BroCard) | 3 BIN types, USD only, 3D Secure available | Facebook, Google Ads | Minimal fee after first 50 free cards | NA |

| Capitalist Card Pro | Mass card issuance, EU bank cards | Facebook, Google Ads | 2.95 USD issue fee, 2.7 USD monthly | NA |

| PST.NET | 25 BINs, 6 card types, USD/EUR | Multiple ad platforms | From $1/card, 2-6% deposit fee | Up to 3% |

| EPN.NET | 42 BINs, 36 Banks, and 12 countries | Best for affliliates | Minimum topup $30 | NA |

| YesCard | Single BIN, 486521 Visa US | Great for media buyers | 1st 50 free and later $0.50 per card | NA |

| AdPos | Unlimited cards, team management | Facebook, Google Ads | Start from $1 per card | NA |

| Volet | Works with multiple cryptos and fiat currencies | NA | Card issuance at US $29.95 | NA |

| Karta.io | Unlimited Card issuance availabele | NA | NA | NA |

| Getsby | Reloadable and single-use cards | Multiple merchants | NA | NA |

| Lamanche Payments | Cards with/without 3DS, free cards | Google, Facebook, TikTok | 3-4.5% commission | NA |

| FlexCard | Offers 3D secure authentication | Google, Facebook, TikTok | Minimum deposit of $50 for USDT, and $100 for Bank transfer | NA |

| Stellar Card | Private BINs, risk-free payments | Facebook, Google Ads | $100/month (4% commision) or $200/month (3% commission) | NA |

| YeezyPay | Payments to bank cards, cryptocurrency top-ups | VISA, MasterCard | 1% exchange commission | NA |

| Webscard | Also offers white label solution for affiliates | Facebook Ads, Instagram Ads, Google Ads, TikTok Ads, DigitalOcean, and more | NA | NA |

| Multicards | Good for ecom and marketing operations | eCom and Media Buying Operations | NA | NA |

| Сardgen | Over 25 card designs available | Multiple ad platforms | 4% charge for card top ups | NA |

| Spendge | Unlimited cards, team management | Multiple ad platforms | €1/card, 1% commission | NA |

| AdsCard | Minimum topup of $1000 (USD/EUR/GBP) and $300 for USDT | Works on multiple platforms | €5/card and €5 monthly maintainence charge | NA |

1. LinkPay

Kicking off with the next-gen virtual cards from LinkPay, word on the street is that it's the brainchild of some former big-shot financial execs, which explains why they're bringing some seriously game-changing features to the table. LinkPay isn't just another virtual card service; it's positioning itself as a next-gen solution for both businesses and individuals.

Offering a whopping 3% cashback on all purchases, with zero deposit fees, LinkPay has established the #1 position on the list. But wait, there's more! LinkPay lets you spend your crypto just like you would with a regular payment card, making it a dream come true for crypto enthusiasts.

LinkPay allows you to avoid those pesky decline fees and deposit charges. Moreover, they've set a low-key withdrawal threshold of a mere $10. Juggling your expenses between crypto, USD, and EUR accounts has never been smoother.

To get started with LinkPay, you don't even need personal documents (in other words, no KYC is required). The process takes just a minute, and you're ready to go:

- Sign up to linkpay.io;

- Deposit your account with crypto without fees (withdrawals are also fees-free btw);

- Issue and top-up your virtual card;

- Now you can spend your crypto at any store with a 3% cashback on all purchases.

Thanks to their subscription model, this service offers the most favorable fees.

We started with the Plus plan and ended up with the Ultra plan as it was so profitable (up to 100 free virtual cards, much better rates, bigger cashback, etc).

LinkPay Key Features

- User-Friendly Interface: LinkPay boasts an intuitive platform that simplifies transactions, making it easy for users to navigate and complete payments efficiently.

- Global Reach with Merchant Feature: This next-gen service allows users to both make and accept payments in over 700 cryptocurrencies and fiat currencies, including Visa/Mastercard transactions in any currency.

- Customer-Centric Approach: LinkPay prioritizes customer satisfaction, offering responsive support and features tailored to meet the needs of even the most demanding media buyers.

- Industry Recognition: In 2024, LinkPay cards were named the top choice by Payments Cards and Mobile, a respected PayTech industry publisher.

- Versatile Payment Options: Users can pay for a wide range of services, including Google Ads, Facebook Ads, TikTok Ads, Amazon, Netflix, and many more.

- Attractive Cashback: LinkPay offers a generous 3% cashback on all purchases, making it a standout choice for frequent online shoppers and businesses.

- Seamless Transactions: The virtual card works just like a regular one, with 3D-secure code confirmations sent directly to the user's email or account for added security.

In addition to all this, LinkPay takes team expense management to the next level with its user-friendly features. You can effortlessly issue virtual credit cards, set spending limits, and track transactions, all while maintaining full control. The Merchant feature allows easy payment processing on your website, supporting both crypto and fiat currencies.

Plus, LinkPay offers an attractive affiliate program (easily score $100+ for every user you bring in) and runs exciting social media (Telegram; X; Facebook; Instagram; LinkedIn) contests, giving you even more reasons to get involved. LinkPay’s comprehensive solution simplifies financial management for businesses of all sizes.

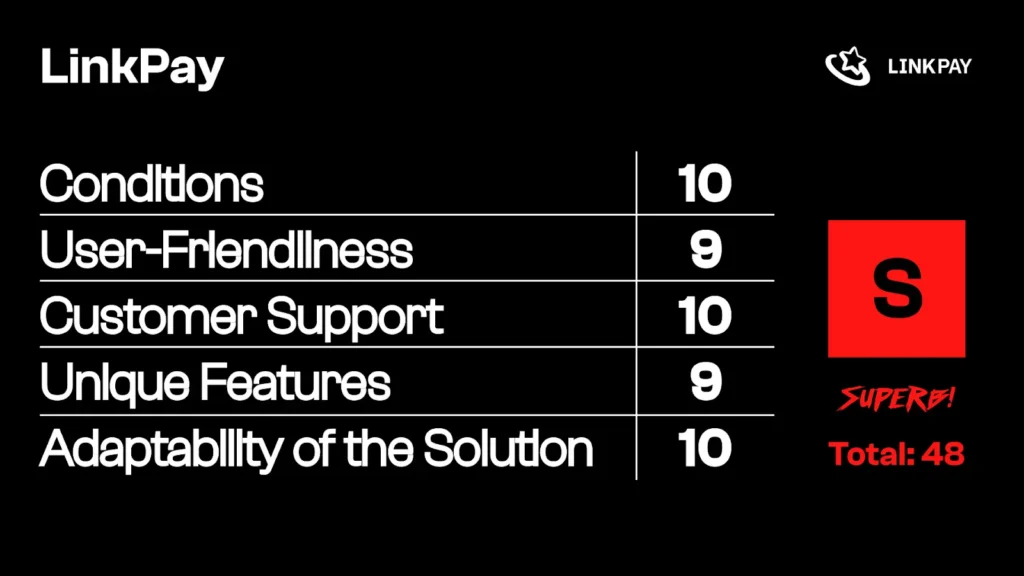

Our Verdict on LinkPay

2. MyBroCard aka BroCard

MyBrocard has emerged as a top-tier virtual card service, especially for media buyers and digital marketers. With a reported user base of over 30,000 clients worldwide (though this number is unverified), it's clear that MyBrocard has gained significant traction in the industry. What sets it apart is its user-centric approach and seamless integration with major advertising platforms like Facebook, Google, and TikTok.

Users rave about MyBrocard's intuitive interface, which makes managing multiple cards a breeze, even for large teams. The service offers competitive fees, reliable transactions, and responsive customer support. One standout feature is the ability to automate account top-ups for team members, a game-changer for organizations with 20+ buyers.

While MyBrocard specializes in advertising payments, it's versatile enough for various online transactions, making it a solid choice for businesses and individuals alike.

MyBroCard Key Features

- Free Initial Cards: The first 50 virtual cards are issued for free, with minimal fees thereafter.

- Responsive Support: Dedicated 24/7 customer support team to quickly resolve issues and answer questions.

- Team Management Tools: Comprehensive features for team collaboration, including role assignments and budget allocation.

- Instant Card Issuance: Ability to create unlimited virtual cards instantly from a single account.

- Diverse BIN Options: Over 25 trusted BINs from various countries, including the USA, for flexible payment solutions.

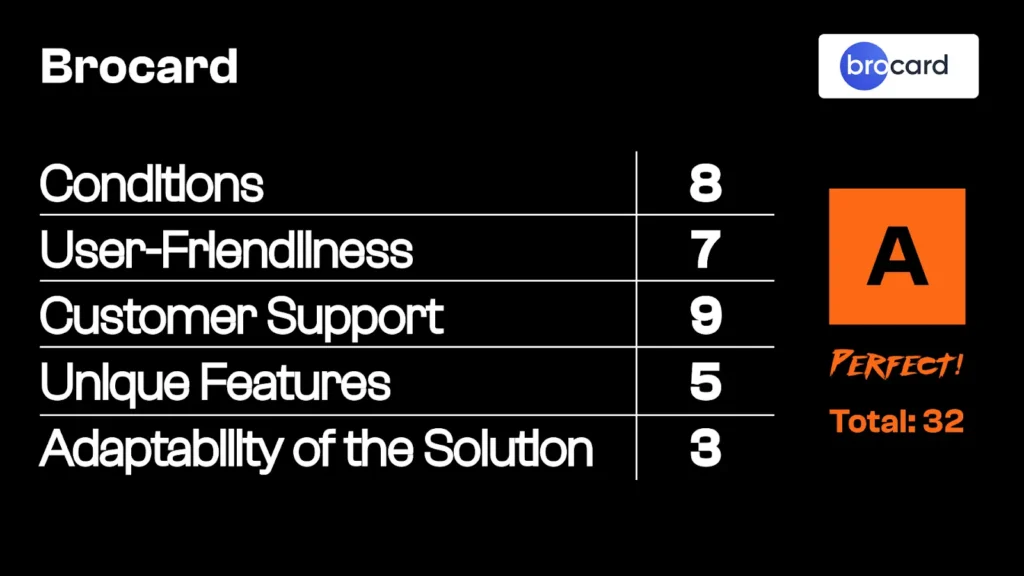

Our Verdict on MyBroCard

3. Capitalist Card Pro

Capitalist CardsPro, a standout service within the renowned Capitalist payment system, excels in the issuance and management of virtual cards. With over a decade of expertise in affiliate marketing, CardsPro is a trusted leader in the industry. Designed specifically for media-buying teams, it simplifies complex advertising campaigns and online transactions across various platforms.

Users can fund their accounts with both fiat currencies and cryptocurrencies, offering flexibility and convenience. The platform supports shared and separate balances, three levels of participant access, and detailed transaction statistics, making it an ideal choice for collaborative teams. With its excellent features and dedicated support, CardsPro is a top-tier solution for managing virtual cards efficiently.

Capitalist Card Pro Key Features

- Unlimited Card Issuance: Create unlimited virtual cards individually or in bulk as needed.

- Flexible Balance Options: Each card can be topped up individually for precise budget control.

- Common Balance: Multiple cards can share a single balance for streamlined management.

- Account Replenishment: Fund your CardsPro account by topping up the associated Capitalist account.

- Diverse Funding Methods: Replenish your balance via bank transfers, cryptocurrencies, or affiliate network payouts.

- No Monthly Fees: No monthly service fee, but transaction and issuance fees apply.

- VIP Client Solutions: Tailored conditions and special terms for high-value clients.

- Multiple BINs Support: Access to various BINs for flexible payment solutions.

- Swift Card Issuance: Rapid setup process with instant card issuance.

- Team Collaboration: Team mode feature for efficient collaboration and budget management.

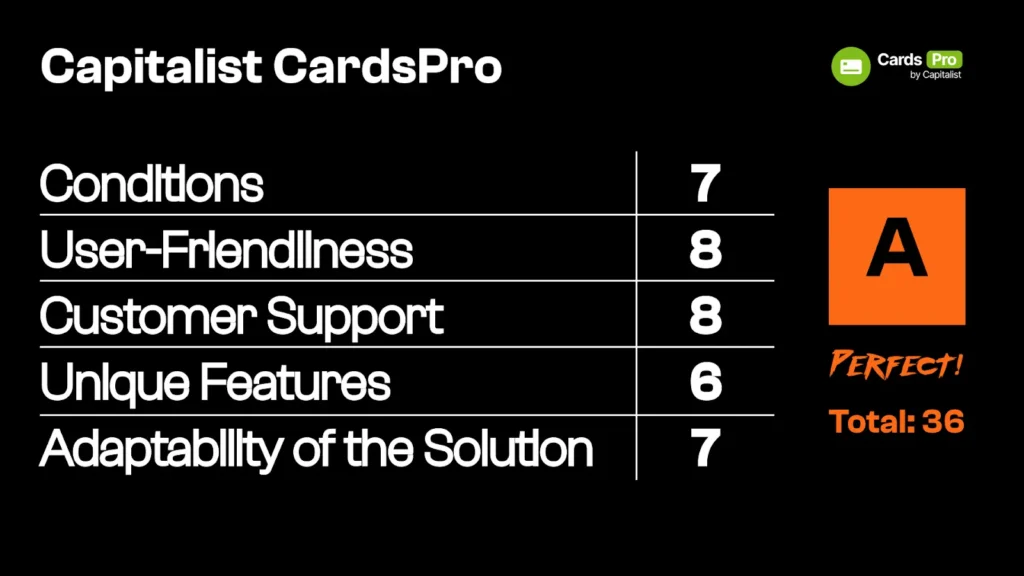

Our Verdict on Capitalist Pro

4. PST.NET

If you're deep into online advertising, affiliate marketing, or shopping, PST.NET Cards are definitely worth a look!

Known for its extensive array of BINs, PST.NET offers an excellent virtual card service tailored for both personal and corporate use. Although the claim of having the most extensive BINs is unsubstantiated, with only 5 BINs available to average users, the service still stands out. BIN, or Bank Identification Number, comprises the first six digits of a card, identifying the issuing bank and providing relevant payment details.

PST.NET cards support secure transactions with 3D Secure, making them ideal for funding accounts on popular ad networks like Facebook and TikTok. With features like instant card issuance and a user-friendly interface, PST.NET simplifies online payments and advertising spending.

PST.NET Key Features

- Abundant Refueling Options: Recharge cards using cryptocurrencies like BTC and USDT, or traditional debit/credit cards.

- High Minimum Withdrawal: Minimum withdrawal amount is $500, with processing times of up to two weeks.

- Experienced Support Team: Dedicated support team available to assist with various user needs and issues.

- 3D Secure Cards: Ensures payment security with 3D Secure technology for safe global transactions.

- Instant Card Issuance: Quickly create virtual cards for immediate use, ideal for dynamic advertising needs.

Also Read 👉 myBrocard vs PST.net vs Capitalist

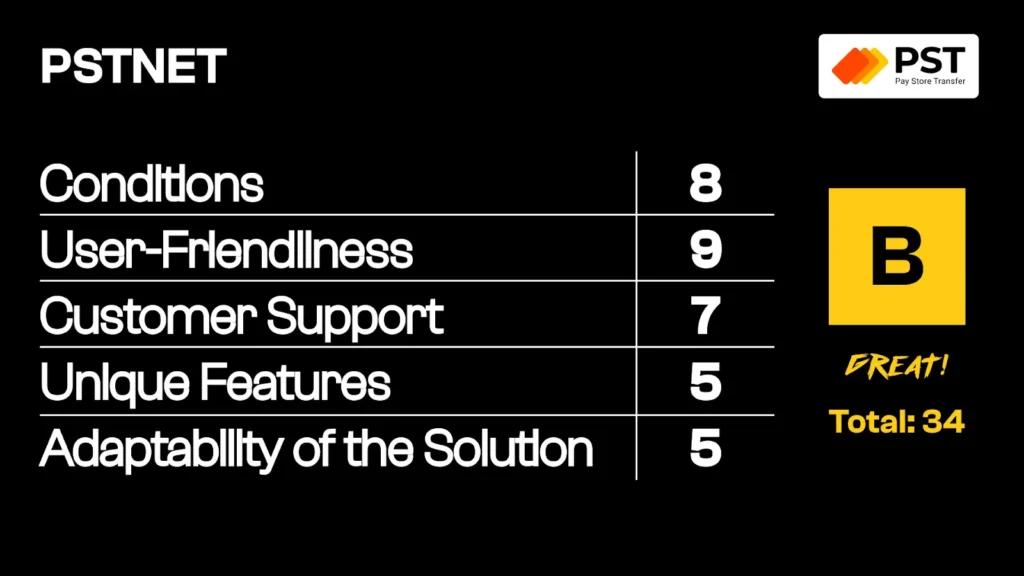

Our Verdict on PST.NET

5. EPN.NET

EPN.NET is a versatile virtual card service designed for online advertising, affiliate marketing, and various online purchases. With a focus on providing reliable and cost-effective solutions, EPN.NET offers instant card issuance and top-up directly from their app. The platform supports a wide range of top-up methods, including cryptocurrencies and traditional payment options, ensuring flexibility for users.

EPN.NET serves a growing network of 42 BINs and 36 banks from 12 countries, providing extensive options for users. Despite some customer service concerns, the service is tailored for affiliates by affiliates, featuring low fees, a user-friendly dashboard, and 24/7 support. EPN.NET aims to streamline online transactions and advertising spending efficiently.

Service Limitation: Account verification is necessary for issuing subsequent cards.

EPN.NET Key Features

- Abundant Funding Options: Fund accounts using USDT, BTC, or traditional wire transfers.

- Low Minimum Top-Up: Minimum top-up requirement is just $30 for a free card.

- Unlimited Card Issuance: Issue unlimited virtual cards without extra charges after KYC verification.

- Instant Card Issuance: Quickly create virtual cards for immediate use.

- US Cards for Media Buying: Tailored US cards ideal for media buying activities.

- Unique Cards for Ad Accounts: Generate unique cards for each ad account at no additional cost.

- Cashback on First Deposit: Earn cashback on the first deposit fee up to $10K.

- Responsive Support: Dedicated support is available on Telegram for quick assistance.

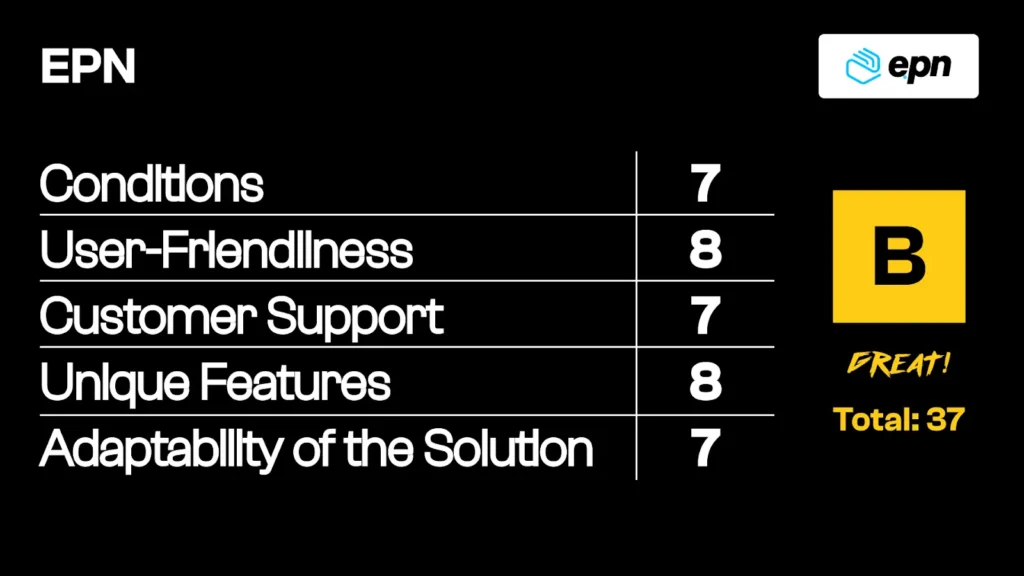

Our Verdict for EPN.NET

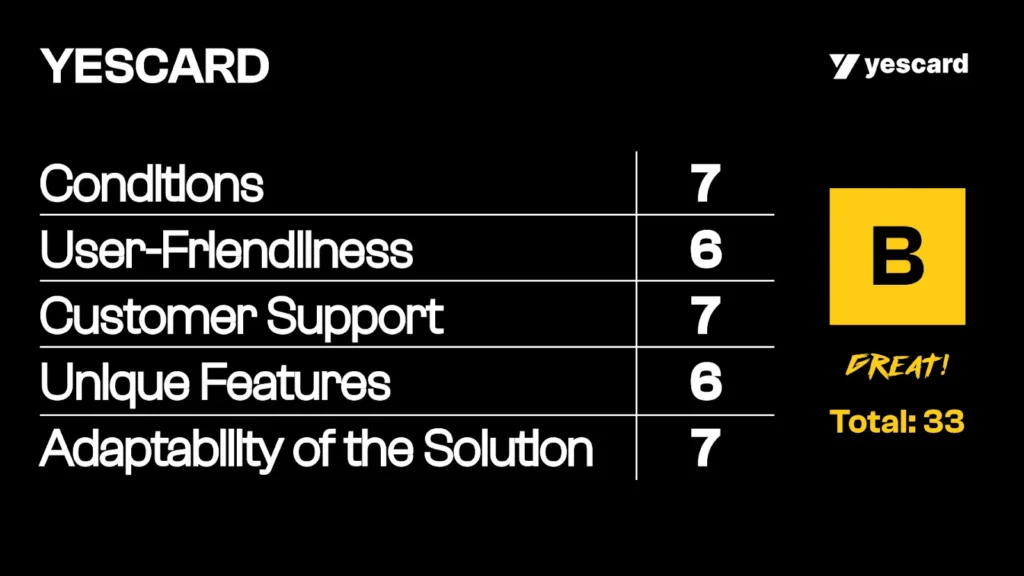

6. YesCard

YesCard positions itself as an essential tool for media buyers and marketers across various platforms. This service streamlines the issuance of virtual cards, making it easy to initiate and manage advertising campaigns in affiliate marketing and media buying.

Equipped with robust spending management tools, YesCard ensures rapid card issuance and convenient top-up options, enhancing collaboration through features tailored for corporate accounts. While YesCard's virtual cards are compatible with various ad networks, they excel particularly on platforms like Facebook.

Currently, YesCard features a single BIN, 486521 Visa US, with plans to expand its BIN offerings in the future. Future updates will enhance functionalities for media buyers, enabling seamless access to affiliate programs and B2B networks directly from the platform.

The minimum deposit requirement is set at $500, and transactions are facilitated smoothly with crypto deposits in USDT. Currently, USDT ERC20 deposits are available, with USDT TRC20 support coming soon.

For larger teams, YesCard offers personalized solutions tailored to specific needs, including a compelling offer of free issuance for the first 50 cards. Beyond the initial allocation, subsequent card issuance incurs a nominal fee of $0.50 per card.

YesCard Key Features

- Centralized Balance Management: Eliminates the need for manual card recharges.

- Unlimited Card Issuance: Issue unlimited virtual cards for advertising payments.

- Adaptable Limit Settings: Set customizable spending limits for enhanced control.

- User-Friendly Filter System: Easily navigate and manage accounts with an intuitive filter system.

- Comprehensive Financial Reports: Access detailed financial reports for better expense tracking.

- Collaborative Team Features: Enhance teamwork with features tailored for corporate accounts.

- GEO Compatibility: Compatible with various GEO locations for expanded reach.

Our Verdict on YesCard

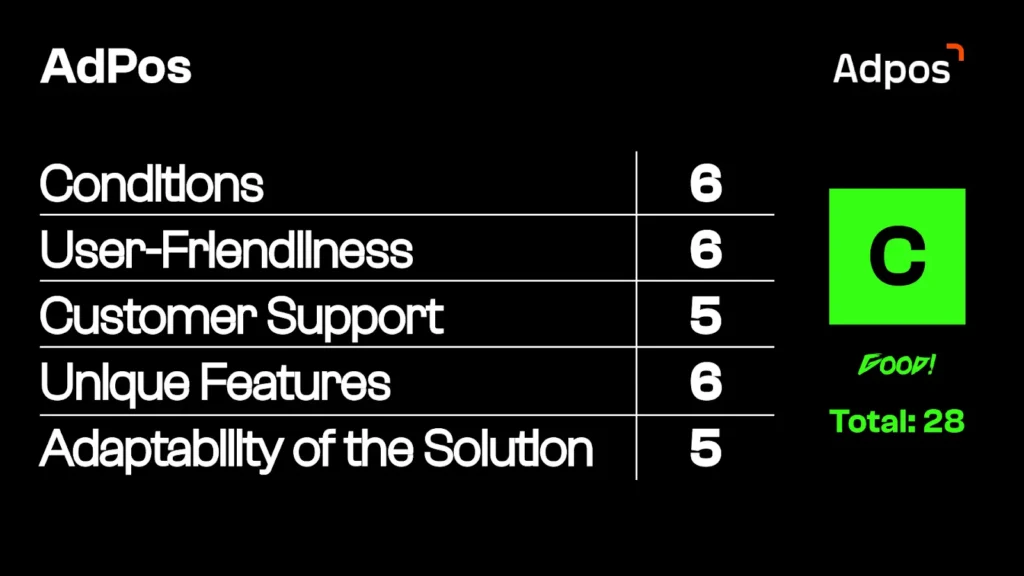

7. AdPos

AdPos Virtual Card is tailored for niche clientele within affiliate marketing and advertising domains, boasting partnerships with over 20 affiliate networks. Refueling card balances is a breeze with options like USDT (TRC20, ERC20), wire transfers, and even Capitalist.

AdPos elevates card management efficiency through features like teamwork functions, platform roles, and subaccounts, serving media buying teams. The virtual cards are finely tuned for Facebook Ads, ensuring seamless integration.

While there are rumors about compatibility with major native ad networks like Taboola and Outbrain, these claims should be taken with caution. AdPos offers robust collaborative functions, detailed billing reports, and a suite of tools for optimizing management efficiency, making it a reliable choice for advertising payments.

AdPos Key Features

- BINs sourced from both Hong Kong and the USA ensure high quality and reliability.

- Competitive rates with Card CAPs start as low as $1, providing cost-effective solutions.

- Seamless replenishment of ad network payments facilitated by partnerships with over 20 leading ad networks.

- Efficient card management capabilities tailored to handle multiple ad accounts effortlessly.

- Features for team management and budget planning enable seamless administration of numerous cards across diverse ad accounts, facilitating allocation and budget management for team members.

- Real-time billing reports are easily accessible through direct integration with payment processing networks, ensuring swift access to transaction records.

Our Verdict on AdPos

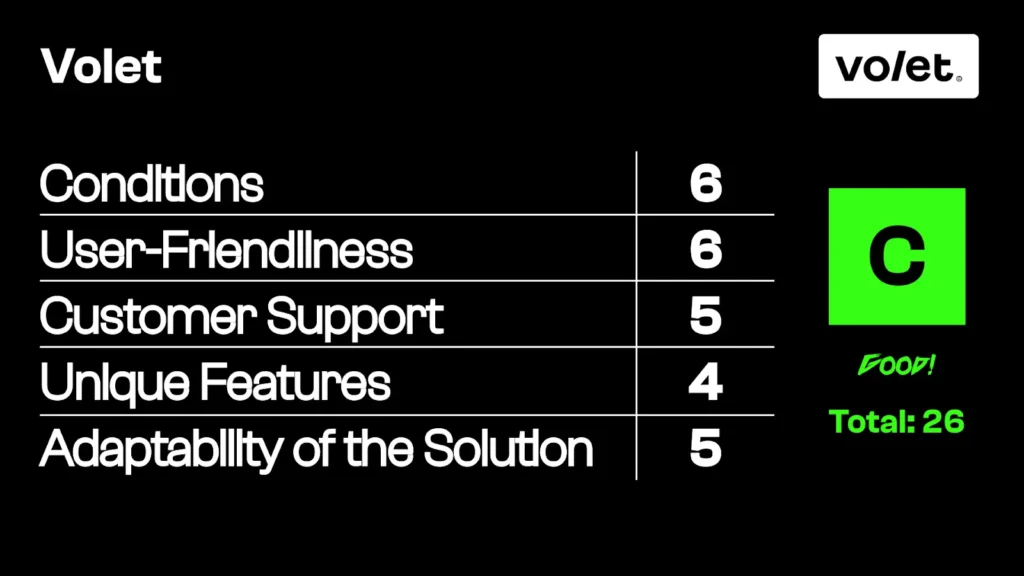

8. Volet

Volet is an updated version of the former AdvCash payment system, which is now in the vast graveyard of virtual card services. Volet supports the crypto lifestyle, supporting a variety of cryptocurrencies including Bitcoin, Litecoin, Ethereum, Ripple, Bitcoin Cash, and ZCash, with plans to expand its roster of digital assets in the future. In addition to these, Volet provides robust support for traditional fiat currencies such as EUR, BRL, KZT, RUB, UAH, and USD.

One of Volet's standout features is its streamlined funding process and ability to manage multiple currencies seamlessly, making it a favorite among enthusiasts of crypto debit cards.

Just a heads-up: users from the USA are currently out of luck when it comes to tapping into Volet.

Volet Key Features

- Centralized Balance Management: Manage all card balances from a single interface.

- Unlimited Card Issuance: Issue an unlimited number of virtual cards.

- Adaptable Limit Settings: Customize spending limits for enhanced control.

- User-Friendly Filter System: Easily navigate and manage accounts with intuitive filters.

- Comprehensive Financial Reports: Access detailed financial reports for better expense tracking.

- Crypto Wallet Integration: Hold BTC, ETH, USDT, and USDC directly within your Volet account.

- High Issuance Fee: The plastic card issuance fee is set at USD 29.95.

- Global Card Options: Plans to introduce Plastic UnionPay and Mastercard cards in USD.

Our Verdict on Volet

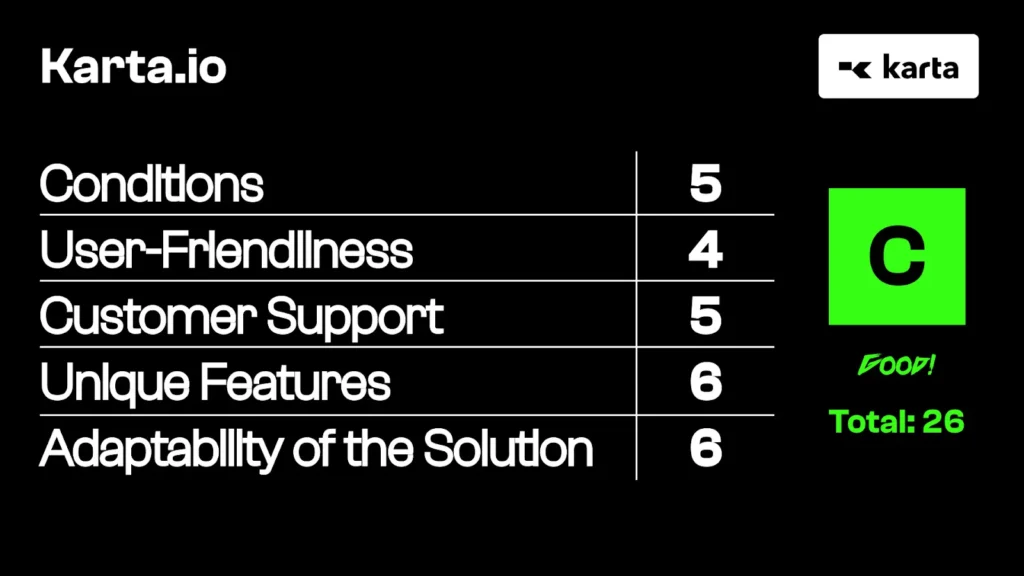

9. Karta.io

Karta.io zeroes in on dishing out budget automation solutions to companies. Their repertoire includes an all-in-one payments hub and virtual cards, paving the way for streamlined operations and freeing up bandwidth for growth and expansion.

Emerging from an internal solution to address team challenges, Karta.io evolved into a platform tailored for a wider corporate clientele.

Targeting financial teams, Karta.io enhances spend management by offering consistency, accessibility, and adaptability, introducing new avenues for your company's financial strategies.

Equipped with Karta.io cards, you can effortlessly generate virtual cards, establish limits, facilitate payments, and maintain control over your expenditures.

Karta.io Key Features

- Unlimited Virtual Cards: Create and manage unlimited virtual cards for various business needs.

- Real-Time Expense Tracking: Monitor transactions and expenses in real time for better financial control.

- Flexible Budget Controls: Set and adjust spending limits for each card to prevent overspending.

- Vendor-Specific Cards: Generate unique cards for each vendor to enhance security and track spending.

- Instant Card Issuance: Quickly issue virtual cards to team members without delays.

Our Verdict on Karta.io

10. Getsby

Getsby is a virtual Mastercard gift card provider, opening doors to spots that welcome the MasterCard stamp. Their forte lies in reloadable cards tailored for both personal and business ventures.

Getsby rolls out an array of virtual cards, from the reloadable Getsby Virtual Green Card to the one-time anonymous debit Getsby Virtual Black Card, and the business-centric Getsby Virtual Gift Card, each designed to cater to distinct customer needs.

The Virtual Green Card comes with a monthly fee of €0.99, applicable after the 2nd month and subject to fund availability. It offers 0% transaction fee, a 3.0% top-up fee with a minimum of €2.00, and an FX fee of 2%.

On the other hand, the Virtual Black Card has no monthly fee, transaction fee, and a 2.0% FX fee.

For the Virtual Business Gift Card EUR and GBP, both have no monthly fee, transaction fee, and a 2.0% FX fee.

Getsby provides three distinct virtual cards: the reloadable prepaid Getsby Virtual Green Card, the one-time usable anonymous debit Getsby Virtual Black Card, and the Getsby Virtual Gift Card tailored for business customers.

Getsby Key Features

- Unlimited Virtual Cards: Create and manage unlimited virtual cards for various business needs.

- Real-Time Expense Tracking: Monitor transactions and expenses in real-time for better financial control.

- Flexible Budget Controls: Set and adjust spending limits for each card to prevent overspending.

- Vendor-Specific Cards: Generate unique cards for each vendor to enhance security and track spending.

- Instant Card Issuance: Quickly issue virtual cards to team members without delays.

- Comprehensive Financial Reports: Access detailed financial reports for better expense tracking.

- Diverse Funding Options: Fund accounts using various methods, including wire transfers and cryptocurrencies.

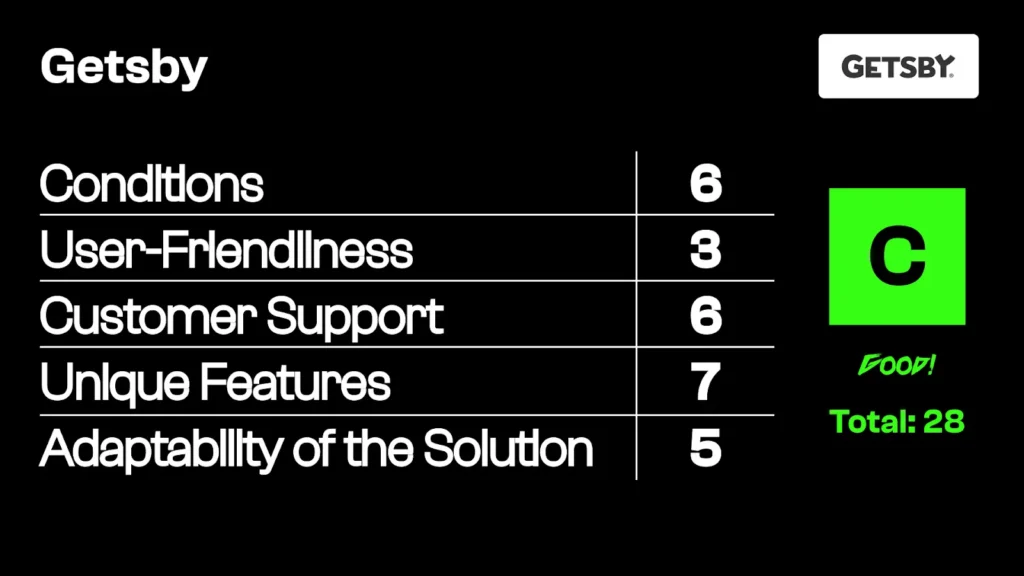

Our Verdict on Getsby

11. Lamanche Payments

Lamanche Payments stands tall, safeguarding the sanctity of BINs while offering a bottomless pit of card issuance sans any pesky issuance or upkeep fees, making it a good alternative to pay for advertising expenses.

Lamanche Payments struts its stuff sans any upfront bills, flaunting a dazzling array of 7 BINs spread across three heavyweight payment systems (Visa, Mastercard, UnionPay), making it a cakewalk to mesh with advertising platforms.

Lamanche Key Features

- 100% return of funds on the tenth day (bad, very long);

- Provision of a dedicated crypto wallet;

- Availability of three payment systems and 7 BINs;

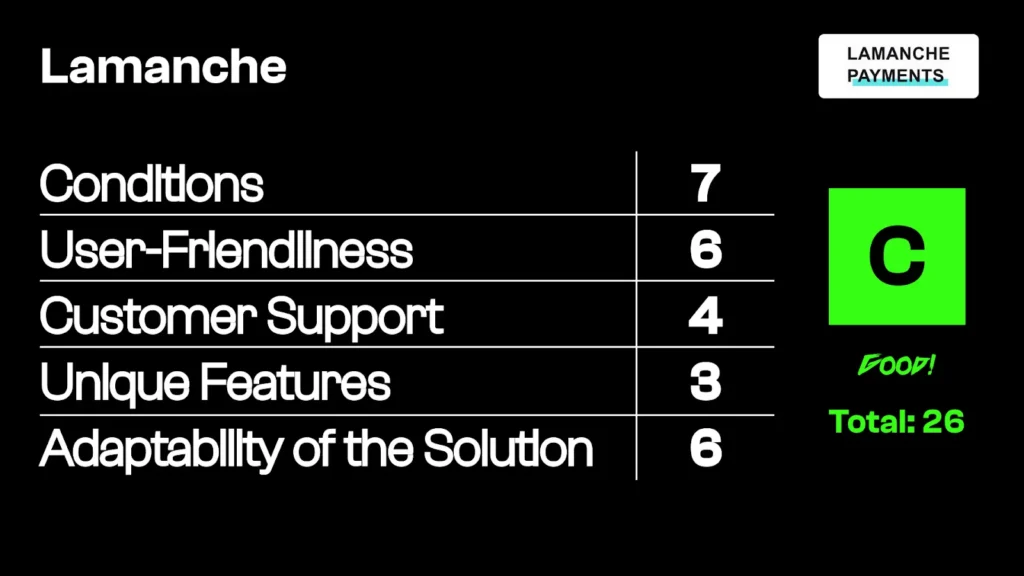

Our Verdict on Lamanche

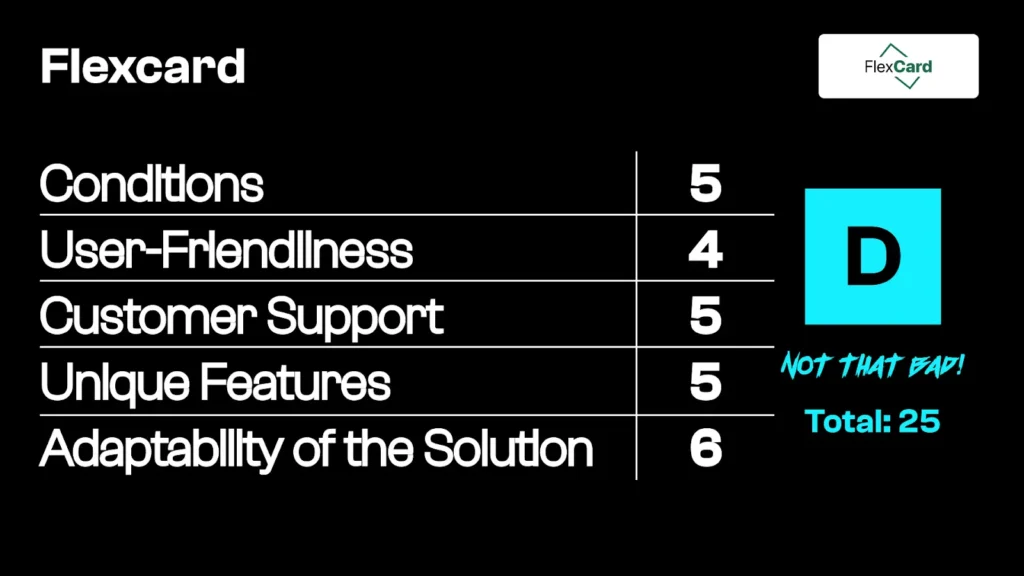

12. FlexCard

FlexCard is a relatively new service with decent terms for Facebook, Google Ads, TikTok, and greasing the wheels for affiliate service payments.

FlexCard is a versatile virtual card service designed for media buyers and marketers. It offers several top-up options, including USDT, bank transfers, and affiliate balances, with a minimum deposit requirement of just $50 for USDT and affiliate top-ups, and $100 for bank transfers.

Each BIN category has distinct replenishment commissions, ranging from 3.5% to 4%. FlexCard ensures rapid card issuance and convenient top-up options, enhancing collaboration through features tailored for corporate accounts. The platform supports seamless transactions on various advertising platforms like Facebook Ads, Google Ads, and TikTok Ads.

With robust security measures, including 3D-Secure authentication, FlexCard provides a reliable and efficient solution for managing advertising payments and online transactions.

FlexCard Key Features

- Card pricing starts at 2 EUR;

- Only three BINs we could access;

- No issuance limits, ensuring swift card issuance;

- 3.5%+ commission for replenishment;

- Minimum replenishment amount of 50 EUR;

Our Verdict on FlexCard

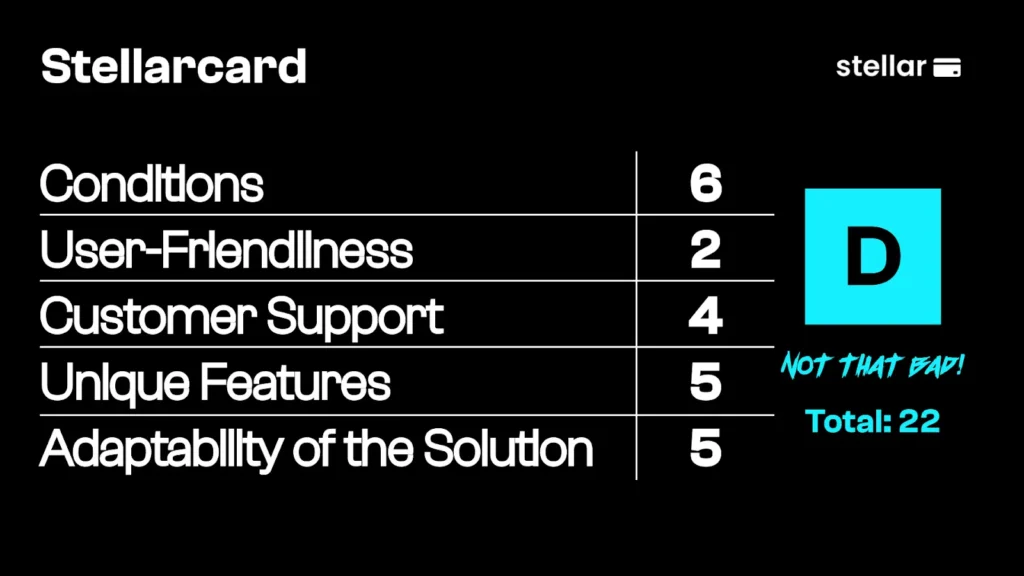

13. Stellar Card

Stellar Card rolls out the red carpet with sweet deals and many BINs for b2b users.

To kickstart your journey with Stellar Card, you need to register on the platform, engage in a brief interview with the support manager, and activate your account.

During the activation process, you'll be required to provide details on your intended traffic sources, your business purposes, and your planned budget. While additional queries may arise, these initial responses typically suffice for activation.

Stellar Card Key Features

- Wide Selection of BINs: Access a diverse range of BINs for various needs.

- Unified Balance Overview: View and manage all card balances from a single interface.

- Customizable Card Limits: Set and adjust spending limits for each card.

- Team Functionality: Differentiate roles between administrators and employees for better management.

- 14-Day Trial Period: Fund your account with a 3% commission during the trial.

- Subscription Plans: Choose from $100/month with 4% commission or $200/month with 3% commission.

- Quick Balance Top-Up: Easily top up your balance immediately after account activation.

Our Verdict on Stellar Card

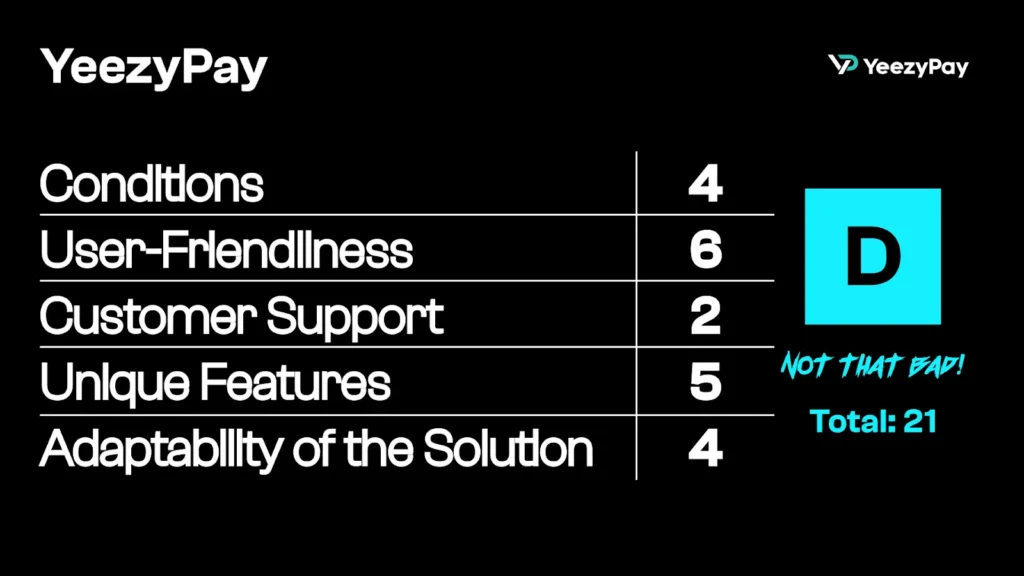

14. YeezyPay

YeezyPay is a specialized service for renting and replenishing agency accounts in popular ad networks like Google Ads, Facebook Ads, and Unity Ads. Designed for media buyers and marketers, YeezyPay offers seamless integration with Google Ads accounts and manual setup for Facebook and Unity Ads.

Users can fund their accounts using USDT (with a 1% exchange commission), bank transfers, or affiliate balances. A 5% commission applies to advertising account replenishments. Agency accounts require an email with no history of Google Ads bans and a verified phone number.

YeezyPay recommends using emails from Europe, Turkey, and the CIS (excluding Russia and Belarus) and advises using anti-detect browsers and proxies for multiple accounts.

Minimum Deposit (including commission): 104 USD In the event of account bans, funds are fully reimbursed to the YeezyPay account (minus a 5% commission).

YeezyPay Key Features

- Intuitive Interface: Simple and user-friendly platform for easy navigation and management.

- Wire/SEPA Replenishment: Fund accounts via bank transfers without extra fees.

- Real-Time Monitoring: Track advertising expenditures in real-time for better financial control.

- High Trust Accounts: Agency accounts with higher ad spend limits and lower ban risks.

- Multiple Payment Methods: Supports USDT, credit cards, and bank transfers for flexible funding.

- Priority Support: A dedicated support team is available 24/7 for quick issue resolution.

Our Verdict on YeezyPay

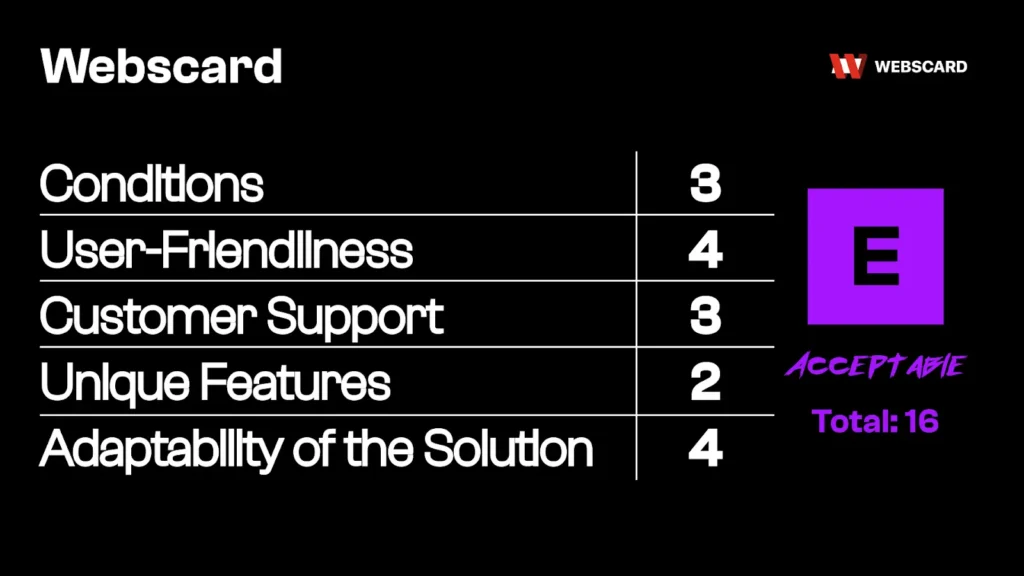

15. Webscard

Webscard is another service with virtual cards designed to elevate your media-buying adventures.

Webscard's solutions are custom-crafted to tackle the business hurdles and demands of media buying squads. Webscard takes pride in its lineup of virtual cards sourced from several banks, although no one knows if this is true.

Webscard's services and solutions are categorized into three main areas:

- Service for issuing international virtual Visa and Mastercard cards with several BINs from European banks for advertising payments, online store purchases, and SaaS services such as Facebook Ads, Instagram Ads, Google Ads, TikTok Ads, DigitalOcean, Heroku, Canva, Adobe, Steam, and PSN.

- White Label solutions tailored for affiliate networks and teams;

- API integration designed for business clients.

Webscard Key Features

- In-house card preprocessing capabilities enabling MCC (Merchant Category Code) restrictions management;

- Versatile card functionalities allowing payments for services, online store purchases, and wallet top-ups like PayPal;

- Gold and Platinum card programs ensuring heightened acceptance rates in advertising networks;

- All conversions are executed at Visa and Mastercard payment system rates.

Our Verdict on Webscard

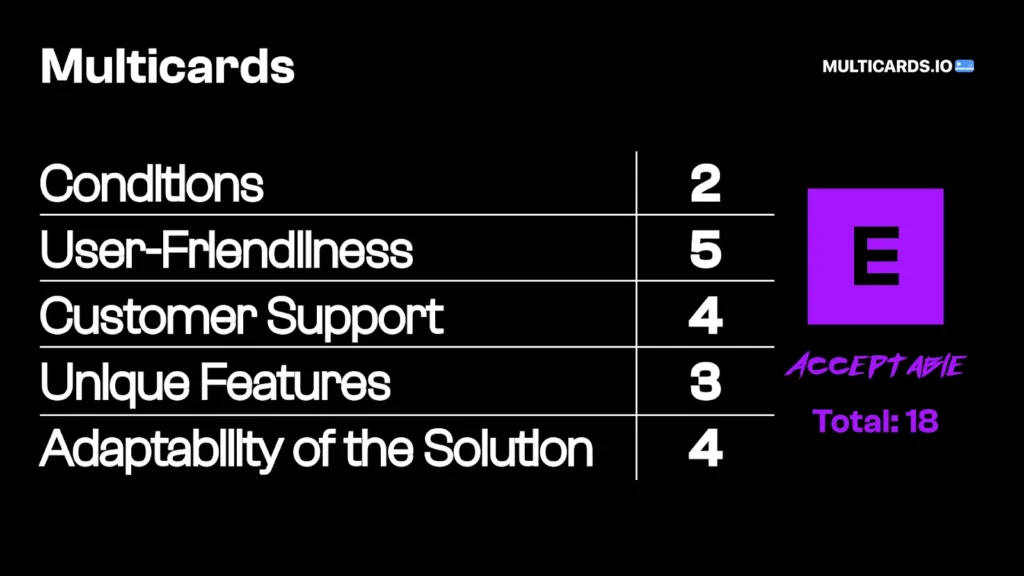

16. Multicards

Multicards strides in as a service that empowers users to whip up virtual cards for online payments, including the nifty ability to settle advertising account bills.

Post-signup, users can swiftly conjure up a virtual card right within the Multicards arena. Customize the card type, set limits, and link it up with your advertising accounts to grease the wheels for campaign payments in a secure and hassle-free manner.

Moreover, Multicards dishes out detailed transaction insights, giving users the power to dissect and handle finances with a touch of finesse. Also offers comprehensive data on payment sums, and transaction timestamps, and receives transaction alerts.

Multicards Key Features

- Access trusted cards through Multicards, ensuring secure payments in advertising accounts with additional protective measures that simplify cabinet operations.

- Set usage limits on virtual cards to effectively control expenses. Establish maximum payment thresholds to prevent unauthorized transactions and manage spending efficiently.

- Multicards provides round-the-clock support to users. Contact our support team at any time for prompt assistance with queries or issues.

- Safeguarding user data integrity, Multicards ensures that transaction and payment information remains confidential and secure. Access all pertinent data conveniently within your account for swift reference.

- At Multicards, prioritize the safety and security of payments and user data. Enhancing security measures, we employ two-factor authentication for access to payment data. All operations undergo continuous monitoring by both users and Multicards' dedicated team.

Our Verdict on Multicards

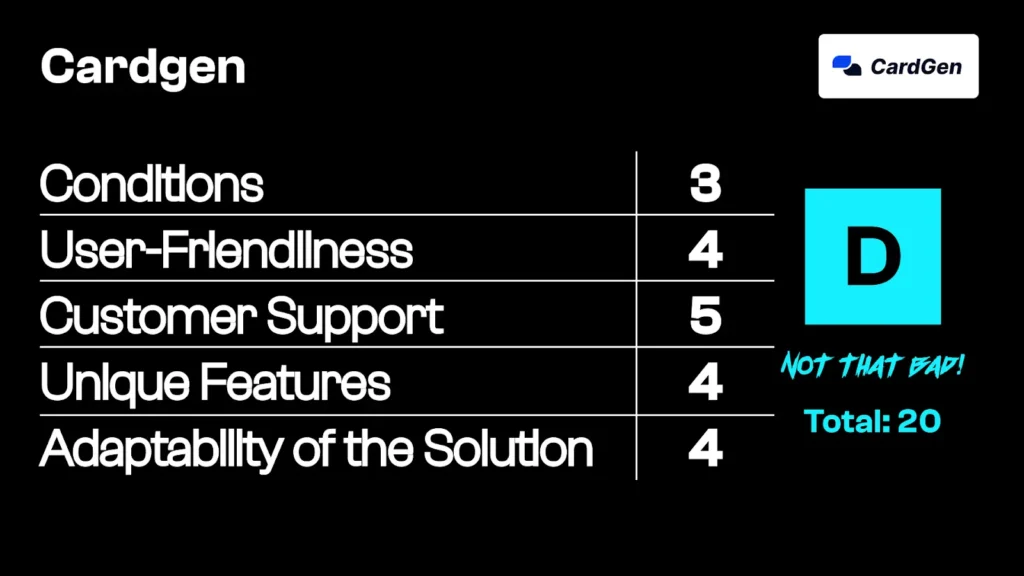

17. Сardgen

Cardgen is a fresh-faced platform offering virtual card solutions finely tuned for media buying. With a straightforward process, users can register, fund their accounts with cryptocurrency, request card issuance, and replenish their card balance. The platform charges a 4% fee for card top-ups, ensuring a seamless and budget-friendly experience.

Cardgen elevates team efficiency by allowing users to issue cards, monitor expenditures, and track transactions with live stats in their personal accounts.

A crucial requirement is an initial card top-up of at least 1000 euros.

Сardgen Key Features

- Instant Card Issuance: Quickly issue virtual cards for immediate use.

- Customizable Spending Limits: Set and adjust spending limits for each card.

- Team Card Issuance: Issue and manage cards for team members efficiently.

- CSV Import Functionality: Easily import data using CSV files for streamlined management.

- Over 25 Card Designs: Choose from a variety of card designs to suit your preferences.

Our Verdict on CardGen Virtual Card

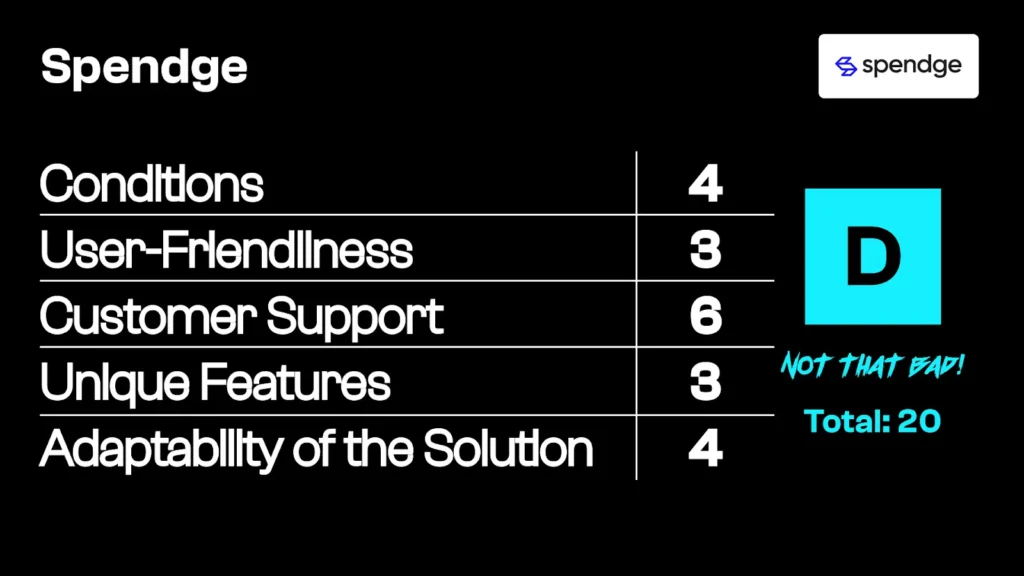

18. Spendge

Spendge is the go-to service for affiliate marketers, offering up virtual cards solely for shelling out those advertising office bills.

With fresh BINs up for grabs at a strange rate of 5 euros per card and the freedom to churn out cards endlessly, Spendge cannot offer the market anything new. Spendge caters to both teams and solo media buyers, offering account types: Individual or Team.

Team accounts feature an administrator who can create sub-accounts for team members.

Virtual Visa/MasterCard cards with UK, Ireland, and Bulgaria BINs are provided by Spendge, with card currencies aligned as follows:

Pricing entails a 5 EUR issuance fee per card and a 5 EUR monthly maintenance charge, automatically debited as a service fee.

Replenishment options include USDT and wire transfer, with a minimum deposit requirement of 300 USDT for cryptocurrencies, subject to a 1.5% deposit commission.

For balance top-ups, users can contact support, with a minimum deposit of 1000 EUR/USD/GBP. A 25 EUR + 0.5% commission applies to replenishments via wire transfer.

Additionally, Spendge imposes a 2.5% commission on deposit amounts, along with a specific commission for BINs starting with the number 4.

Spendge Key Features

- Intuitive Interface: Simple and user-friendly platform for easy navigation and management.

- Google Ads Compatibility: Seamlessly integrates with Google advertising platforms for efficient campaign management.

- Wire/SEPA Replenishment: Fund accounts via bank transfers without extra fees.

- Real-Time Monitoring: Track advertising expenditures in real-time for better financial control.

- 1% USDT to USD Exchange Fee: Low commission for converting USDT to USD.

- 5% Replenishment Commission: A 5% fee applies to advertising account top-ups.

- Refund Policy: Deposit refunds minus 5% commission if an agency account is banned.

Our Verdict on Spendge

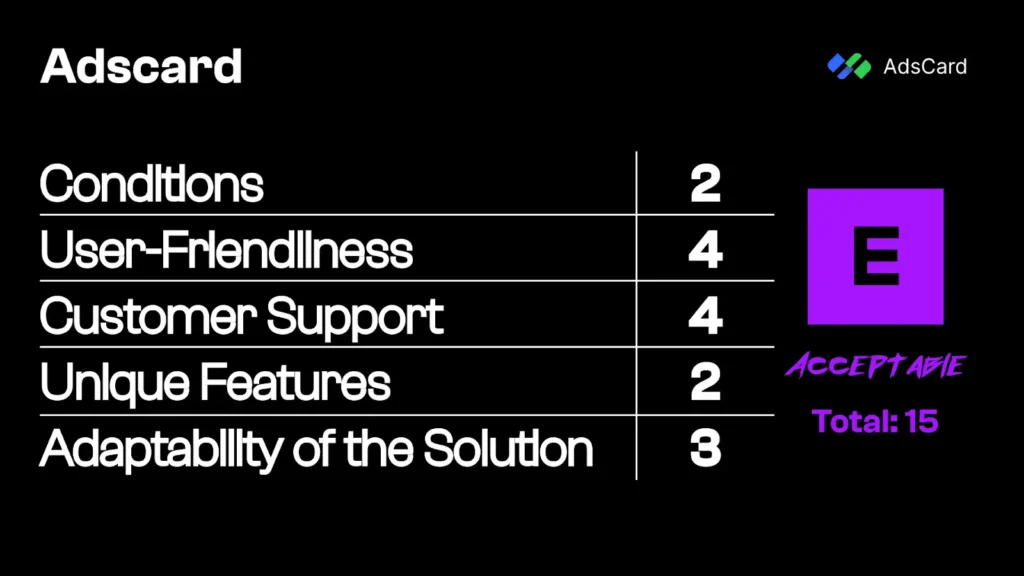

19. AdsCard

The virtual cards from AdsCard harmonize effortlessly with a plethora of international advertising platforms and networks, ensuring a seamless ride for users across the globe.

Users can effortlessly top up their virtual cards from AdsCard in dollars via TRC, ERC, Capitalist, or the classic bank transfer, with the freedom to splurge those funds in dollars, euros, and pounds.

Committed to bespoke tailoring, AdsCard serves up a smorgasbord of customized features and settings, both at the account and platform levels. For those craving a taste of teamwork, AdsCard allows users to craft team accounts, empowering captains to steer the ship, manage expenses, set limits, and more. Teams can snag personal BINs for a touch of flair and control, with a modest fee in tow.

Teams can sync AdsCard's banking service with their platform, ushering in a new era of efficient expense management tailored specifically for the Republic of Kazakhstan within their very own system. Have you watched Borat?

AdsCard Key Features

- Unified Account Balance: Manage all funds from a single balance without card-specific limits.

- Pre-Linked FB Accounts: Access a marketplace with pre-linked Facebook accounts for seamless advertising.

- Custom Card Grouping: Organize cards into custom groups for streamlined management.

- Low Decline Rate: Enjoy a low transaction decline rate for smoother operations.

- Flexible Top-Up Options: Easily top up your account using various payment methods.

Our Verdict on AdsCard

Types of Virtual Cards

Quenching Questions Related to Virtual Cards

How do Virtual Cards Differ from Physical Cards?

Virtual cards are digital-only, can be created instantly, and offer more flexibility in terms of spending limits and merchant restrictions. They can't be physically lost or stolen.

Where Can I Use a Virtual Card?

Virtual cards can be used for online purchases, in-app payments, and contactless in-store transactions when added to a digital wallet like Apple Pay or Google Pay.

Can I Get Cash From an ATM with a Virtual Card?

Typically, no. Virtual cards are primarily designed for online and contactless payments, not for ATM withdrawals or physical transactions requiring card insertion.

How Long Does a Virtual Card Last?

The lifespan of a virtual card varies. Some are single-use, others last until a set expiration date, and some can be used indefinitely until manually deactivated.

Can I Have Multiple Virtual Cards?

Yes, most providers allow you to create multiple virtual cards, each with its own number and customizable settings for different purposes or merchants.

More Power to You

So there you have it, folks – the lowdown on virtual cards! They're like the superheroes of the payment world, swooping in to save the day with their flexibility, security, and convenience.

From keeping your online shopping safe to managing your business expenses, or just having a backup payment option, there's a virtual card out there for you.

The best part? You can create and use them right from your phone or computer. No more fumbling with physical cards or worrying about losing them. Virtual cards put the power of secure, hassle-free payments right at your fingertips.

So, which virtual superhero are you getting along with?